The Process

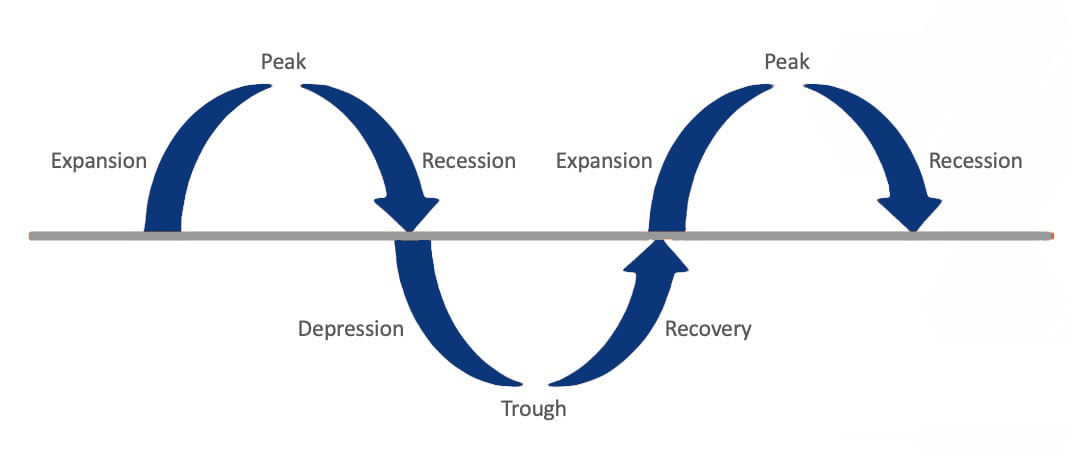

Our full-cycle investment strategy includes investing for bear, bull, and everything in-between market conditions.

![]()

Full Cycle Investing

To stay ahead of the curve. We look for signposts that tell us exactly we are in the cycle so that we can help you make the right investments at the right time. Open your mind up to making changes to your portfolio based on where you are in the cycle. Full Cycle Investment requires you to be active. You are effectively trimming your portfolio so that you can outperform the market.

We believe utilising the Full Cycle Investment strategy will allow you to play to the strengths of the market and will provide you with the highest probability of return. Talk to us about Full Cycle Investing to maximise your growth potential today.

Asset Based Investing

Although there are no guarantees, below are a few assets that we think, in combination, have the potential to not only help preserve capital in the present environment, but hopefully continue to grow it in a good risk-adjusted manner:

- Equities in relatively depressed markets – “value” investing which is the art of buying stocks which trade at a significant discount to their true value, has been in the doldrums, relatively speaking, for about a decade now.

- Alternative strategies – It’s fair to say that from a full-cycle perspective we think there’s probably more risk to the growth style presently than there is absolute upside with the value style. We think a good way to supplement this bias is therefore in strategies that have the ability to generate positive returns when markets are falling.

- Gold – In an environment where profit margins are already very high, bond yields are close to all time lows and the dollar is close to its peaking, we think gold becomes a more interesting proposition as part of a diversisfied proposition, with potentially good upside.

- Cash – otherwise known as “dry powder”, has considerable value here, not because of the return it currently generates, but because of the opportunity it affords investors to establish more constructive positions as forward-looking returns improve. Being fully-invested in a bull market feels great.

![]()